CHATTANOOGA ROOTS PROPERTY TEAM

- Home

- Client Reviews

- Buy Or Sell Real Estate

- View Our Listings

-

Closed Listings

- 412 Derby St 2024

- 306 E Gordon Ave-2024

- 557 Meadow Lark Rd-2023

- 902 Old Lower Mill Rd-2024

- 200 Manufacturers Rd-2023

- 3405 Glendon Drive-2024

- 211 S St Marks Ave 2024

- 5615 Saint Elmo Ave-2024

- 4540 N Ravenwood-2023

- 1723 Gable Green Dr-2023

- 6105 Lottie Ln-2024

- 1638 Short Leaf Ln-2024

- 2604 Fairmount Pike-2023

- 1414 Continental Dr-103-2023

- 1709 W 43rd St-2024

- 3236 Stillmeadow Ln-2023

- 717 Mississippi Ave-2023

- 209 S St Marks Ave-2023

- 8460 Kennerly Ct-2023

- 2333 Red Tail Ln-2023

- 411 Tucker St-2023

- 2303 Marco Cir-2023

- 3714 Rosalee Terr-2023

- 1005 Southbridge Ln-2023

- 114 S Howell-2023

- 5789 Sarah Dr-2023

- 205 Booth Rd-2023

- 3208 Ozark Cir-2023

- 2164 Dugan St-2023

- 3217 Alta Vista -2023

- 3331 Browndell Rd-2023

- 7275 Falcon Bluff Dr-LOT--2022

- 8608 Kensley Ln-2023

- 352 Derby Cir-2023

- 1335 Jackson Mill-2023

- 3371 Adkins Rd-2022

- 1123 Valentine Cir-2022

- 4117 Mayfair Ave-2022

- 3378 Adkins Rd-2023

- 5000 St Elmo Ave-2022

- 3598 Knollwood Hill Dr-2022

- 215 Lake Ave-2022

- 3910 Lake Haven-2022

- 5303 St Elmo Ave-2022

- 621 N Moore Rd-2022

- 903 S Willow St-2022

- 1411 Marlboro Ave-2022

- 1976 Hardwood Ln-2022

- 0 Horns Creek Rd-2022 Land

- Our Team

- Referral Directory

- Things to Do Around Town

- Videos With Chattanooga Roots

-

Blog-Market Update

- Hixson, TN Real Estate Market: April Insights

- Understanding the Real Estate Market in Signal Mountain, TN

- The Low Rate Trap: Why First-Time Homebuyers Feel Stuck in Their Starter Homes

- Tax Season Hustle: Turning Your Refund into Real Estate Riches!

- The Unwritten Rules of Real Estate Etiquette: A Guide to Navigating the House Hunt

- Home Reno Hacks: 10 Tips Inspired by Your Favorite Shows

- Buy Me Doors Not Diamonds

- Harvesting Memories: A Toast to October's Festivities

- 10 Reasons To Not Hate an HOA

- Highland Park, A Neighborhood of History and Charm

- Weekend Getaways This Summer near Chattanooga

- Chattanooga on a Budget: Affordable Adventures in the Scenic City

- Chattanooga Real Estate Market: A Steady Summer Inventory

- Chattanooga's Still Hot in The Real Estate Market

- Chattanooga Chow: Savoring the Best Bites and Booze in the Scenic City

- Signal Mountain: A Historical Gem in Chattanooga Real Estate

- The Joys of Living in a Walkable City

- Lookout Mountain: A Breathtaking Destination with a Rich History

- Chattanooga TN Real Estate: The Pros and Cons of Renting vs. Buying

- Discovering the Charming History of Fort Wood

- Blog-Chattanooga TN and its housing market

- Blog-Top 5 Reasons Chattanooga TN is a great place to live

- Getting Ready to List? Here's Some Spring Cleaning Tips to Get Started

|

Well, friends, it's time to take a peek under the hood and see what the housing market is up to. And... all I can say is that it's the same hot mess under the hood as it was last year. Interest rates are still hovering between 6-7%. It has become apparent that 6-7% interest rates will be the new normal, with 5-6% being the new good rates and above 7% indicates the market is heading into rougher waters.

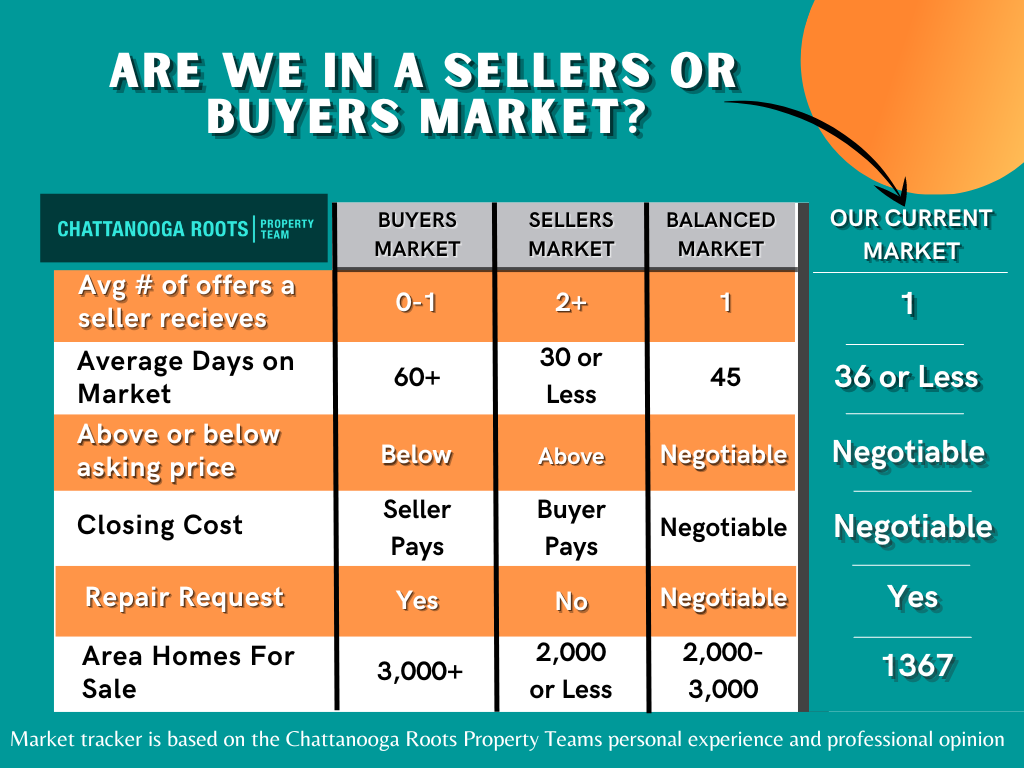

If you take a gander at the stats in the graphic above, you will see, in my opinion, that we are approaching a balanced market. To my mind, this data would suggest that home prices should be softening. However, that is not occurring, at least not yet. It seems like home prices in Chattanooga are being supported by good old-fashioned supply and demand forces. Housing numbers peaked out late last year at approximately 2,000 actively listed homes in the Chattanooga Area MLS. As of today, there are approximately 1,367 homes actively listed. This slide in housing supply and the uncertainty of the market have caused some potential sellers to be hesitant to list. Yet, the people just keep on moving here. According to a recent article, for every one person that moves away from Chattanooga, three move in. If this continues, not withstanding economic catastrophe and/or the FED hammering down even further than their latest revised estimates, I don't foresee too much softening in home prices in Chattanooga. With our median home prices still being significantly lower than the rest of the country, our increased popularity, the continued dissatisfaction by residents of other states, and people's increasing ability to work from anywhere...Well, that is what I like to call a silver lining when it comes to home price stability in Chattanooga. I can hear the cries of outrage about the increased, well, everything that comes from the influx of new residents. However, that influx is a key reason why you can still sell your home for a profit in Chattanooga. So, is it still a good time to buy or sell a home? Despite the odds, in Chattanooga, it still is a good time to sell. As for buying a home, it's a different story. Financing in this market is a bit uncertain, and it's not wise to buy just because you want a larger garage or a more luxurious home unless you are putting a decent chunk down. Nevertheless, if you need to move because of work or have added a new family member and need more space... those types of "life change" moves are still happening every day. Compared to the rest of the country, Chattanooga is a value, and our market is still healthy. Thank goodness! Till next time, Dave...

0 Comments

While we are still FIRMLY in a sellers market things are rapidly shifting. Less than 60 days ago we had 650 homes on the market. As you can see from the chart above we've seen a nearly 33% increase in homes actively listed. There's always a summer jump but this is more than just a seasonal bump. While that is an unusually high rate of increase it is important to remember, as the chart above highlights, a balanced market would have approximately 2500 homes listed. We have a long way to go before we achieve balance and interest rates are going to be a factor in the rate at which the market shifts.

With interest rates in the low to mid 5% range, an economic slow down occurring and inflation running amuck, there is virtually NO ONE predicting a decline in interest rates in the near to midterm. That being said, we are still seeing very high demand for homes in Chattanooga with very little change to what sellers can expect. It looks like the housing market nationally will slow with the rate of equity gains definitely decreasing this year over last. The big caveat for those in TN, Texas, and Florida is the mass influx of new residents which is the X factor for us locally. As long as migration continues at the rate it has been and interest rates stay below 6% we should be able to expect our equity gains, while moderating a bit, to still be very respectable. So....Should you buy/list now or wait? Are you worried that lower rates are right around the corner and you should wait for them to drop? Unfortunately it looks like 5%+ interest rates are the new normal for the foreseeable future. I don't hear anyone saying interest rates will return to below 5%. If you wait to buy/sell in the future you are likely to get the same rate OR higher. The silver lining is, if the rates do go down after you buy, you could refinance and take advantage of those lower rates. The one thing I am virtually certain of is our local housing costs will be higher in 5 years than they are today, making now the time to buy and sell. We still believe it's an amazing time to both buy and sell a home but we do so see potential headwinds on the horizon. Until next time.. David Henson & the Chattanooga Roots Property Team Keller Williams Greater Downtown Realty |

BUY OR SELL REAL ESTATE l LISTINGS FOR SALE l SOLD LISTINGS l CLIENT REVIEWS l OUR TEAM l REFERRAL DIRECTORY l BLOG l PRIVACY POLICY

- Home

- Client Reviews

- Buy Or Sell Real Estate

- View Our Listings

-

Closed Listings

- 412 Derby St 2024

- 306 E Gordon Ave-2024

- 557 Meadow Lark Rd-2023

- 902 Old Lower Mill Rd-2024

- 200 Manufacturers Rd-2023

- 3405 Glendon Drive-2024

- 211 S St Marks Ave 2024

- 5615 Saint Elmo Ave-2024

- 4540 N Ravenwood-2023

- 1723 Gable Green Dr-2023

- 6105 Lottie Ln-2024

- 1638 Short Leaf Ln-2024

- 2604 Fairmount Pike-2023

- 1414 Continental Dr-103-2023

- 1709 W 43rd St-2024

- 3236 Stillmeadow Ln-2023

- 717 Mississippi Ave-2023

- 209 S St Marks Ave-2023

- 8460 Kennerly Ct-2023

- 2333 Red Tail Ln-2023

- 411 Tucker St-2023

- 2303 Marco Cir-2023

- 3714 Rosalee Terr-2023

- 1005 Southbridge Ln-2023

- 114 S Howell-2023

- 5789 Sarah Dr-2023

- 205 Booth Rd-2023

- 3208 Ozark Cir-2023

- 2164 Dugan St-2023

- 3217 Alta Vista -2023

- 3331 Browndell Rd-2023

- 7275 Falcon Bluff Dr-LOT--2022

- 8608 Kensley Ln-2023

- 352 Derby Cir-2023

- 1335 Jackson Mill-2023

- 3371 Adkins Rd-2022

- 1123 Valentine Cir-2022

- 4117 Mayfair Ave-2022

- 3378 Adkins Rd-2023

- 5000 St Elmo Ave-2022

- 3598 Knollwood Hill Dr-2022

- 215 Lake Ave-2022

- 3910 Lake Haven-2022

- 5303 St Elmo Ave-2022

- 621 N Moore Rd-2022

- 903 S Willow St-2022

- 1411 Marlboro Ave-2022

- 1976 Hardwood Ln-2022

- 0 Horns Creek Rd-2022 Land

- Our Team

- Referral Directory

- Things to Do Around Town

- Videos With Chattanooga Roots

-

Blog-Market Update

- Hixson, TN Real Estate Market: April Insights

- Understanding the Real Estate Market in Signal Mountain, TN

- The Low Rate Trap: Why First-Time Homebuyers Feel Stuck in Their Starter Homes

- Tax Season Hustle: Turning Your Refund into Real Estate Riches!

- The Unwritten Rules of Real Estate Etiquette: A Guide to Navigating the House Hunt

- Home Reno Hacks: 10 Tips Inspired by Your Favorite Shows

- Buy Me Doors Not Diamonds

- Harvesting Memories: A Toast to October's Festivities

- 10 Reasons To Not Hate an HOA

- Highland Park, A Neighborhood of History and Charm

- Weekend Getaways This Summer near Chattanooga

- Chattanooga on a Budget: Affordable Adventures in the Scenic City

- Chattanooga Real Estate Market: A Steady Summer Inventory

- Chattanooga's Still Hot in The Real Estate Market

- Chattanooga Chow: Savoring the Best Bites and Booze in the Scenic City

- Signal Mountain: A Historical Gem in Chattanooga Real Estate

- The Joys of Living in a Walkable City

- Lookout Mountain: A Breathtaking Destination with a Rich History

- Chattanooga TN Real Estate: The Pros and Cons of Renting vs. Buying

- Discovering the Charming History of Fort Wood

- Blog-Chattanooga TN and its housing market

- Blog-Top 5 Reasons Chattanooga TN is a great place to live

- Getting Ready to List? Here's Some Spring Cleaning Tips to Get Started